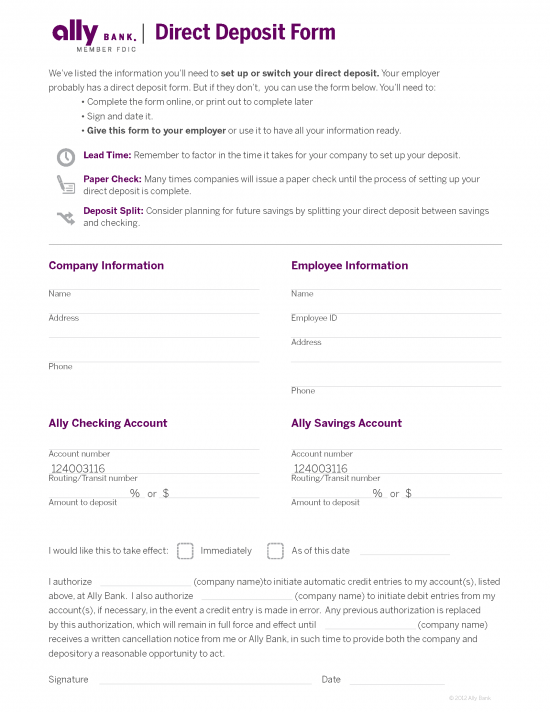

The Ally Bank direct deposit authorization form is one which allows an individual to ask a company or agency to credit their checking or savings account directly as opposed to payment via company issued checks. More often than not, an employer will have a direct deposit form at the ready for such demands. However, if this is not the case and you’re a client of Ally Bank, complete and print off the form below and hand it to your employer with your account number and the bank’s routing number (as seen below) present.

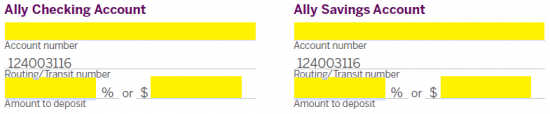

- Ally Bank Routing Number – 124003116

How to Write

Step 1 – You can choose to complete the form online, or print it off and complete it by hand. Regardless, you will need to download it in Adobe PDF.

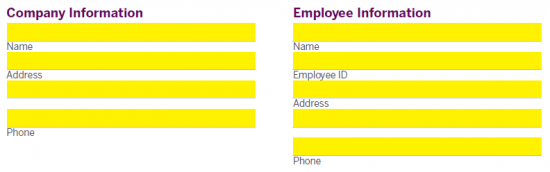

Step 2 – The first section under the heading “Company Information” will require you to enter in the name of the company issuing payments, the address, and the company phone number. The column to the right will require you to supply your “Employee Information” which will include your full name, employee ID, full address, and phone number.

Step 3 – You may choose to deposit the funds into your checking or savings account. Whichever you choose, you must enter the account number and the amount to be deposited (either a percentage or the full amount).

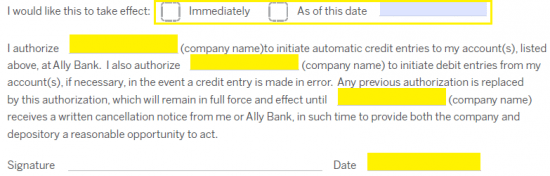

Step 4 – You can choose here whether you would like these payments to take effect immediately or at a later date. Check the applicable box and provide the date if you selected “As of this date.” Next, enter the company name in each field of the authorization paragraph, give it a once over, then provide the date and your signature (once the form has been printed). Hand the completed form to your employer to complete the process.