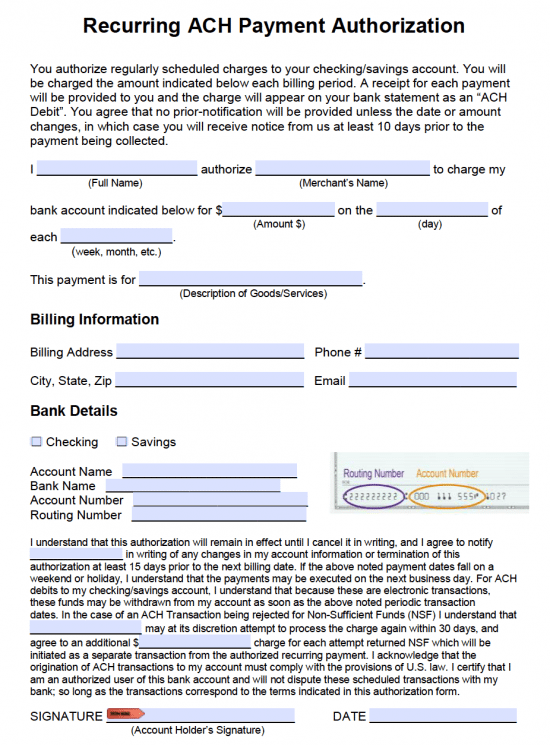

The ACH recurring payment authorization form is used to permit a company, bank, or merchant to perform regular and scheduled withdrawals from an individual’s checking or savings account. The frequency of the transactions can be specified within the form to cater to the needs of the company and the client, providing an efficient way to pay monthly bills. No prior notification will be provided to signal that the account will be debited, however, should the date or the amount of the withdrawal change, an alert will be sent via email or phone. It should also be noted that the cancellation of this type of form will only be effective if notice is given in writing 15 days prior to the next date of billing.

How to Write

Step 1 – Download your Authorization form in either Adobe PDF or Microsoft Word (.docx).

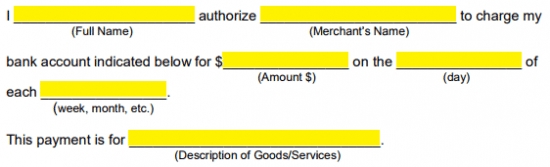

Step 2 – Begin by providing your full name along with the merchant’s name to whom you’re granting authority. Next, enter in the amount of money to be withdrawn, the day it’s to be withdrawn, and the frequency of the withdrawals. Finally, enter in the description of the goods and/or services that the withdrawals are paying for.

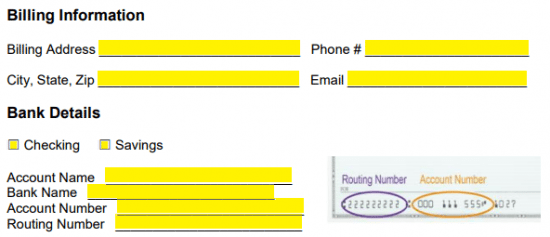

Step 3 – Your billing information and account details must be submitted next. Enter in the following:

- Billing Address

- Phone Number

- Email Address

- Checking or Savings account (choose one)

- Account Name

- Bank Name

- Account Number

- Routing Number

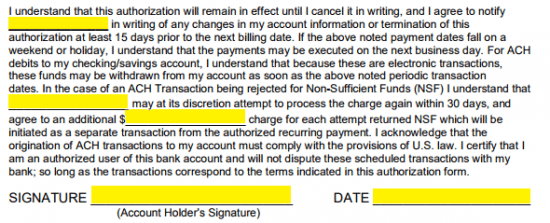

Step 4 – Read over the paragraph, ensuring you have a full understanding of what it is you’re signing off on. Then, provide the authorized individual’s name in the first two fields. An additional charge must be predetermined and identified in the form in the case that the debited account has Non-Sufficient Funds when charged. Enter in the date of completion of the form, print off the document, and provide your signature.